On May 16, the IRS released Revenue Procedure 2023-23, which provides the inflation-adjusted limits for health savings accounts and high-deductible health plans for 2024. The IRS is required to publish these HSA and HDHP limits by June 1 of each year.

These limits include:

- the maximum HSA contribution limit;

- the minimum deductible amount for HDHPs; and

- the maximum out-of-pocket expense limit for HDHPs.

These limits vary based on whether an individual has self-only or family coverage under an HDHP.

Eligible individuals with self-only HDHP coverage will be able to contribute $4,150 to their HSAs for 2024, up from $3,850 for 2023. Eligible individuals with family HDHP coverage will be able to contribute $8,300 to their HSAs for 2024, up from $7,750 for 2023. Individuals age 55 or older may make an additional $1,000 “catch-up” contribution to their HSAs.

The minimum deductible amount for HDHPs increases to $1,600 for self-only coverage and $3,200 for family coverage for 2024, up from $1,500 for self-only coverage and $3,000 for family coverage for 2023. The HDHP maximum out-of-pocket expense limit increases to $8,050 for self-only coverage and $16,100 for family coverage for 2024, up from $7,500 for self-only coverage and $15,000 for family coverage for 2023. Learn more about finding and using HAS-eligible HDHPs.

Action steps

Employers that sponsor HDHPs should review their plan’s cost-sharing limits when preparing for the plan year beginning in 2024. This includes your minimum deductibles and maximum out-of-pocket expense limit. Also, employers that allow employees to make pre-tax HSA contributions should update their plan communications for the increased contribution limits.

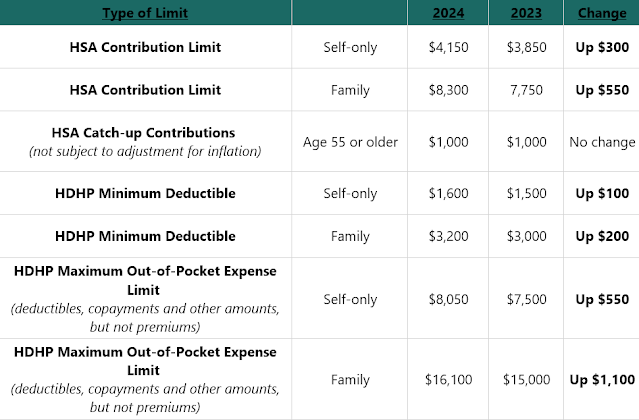

HSA and HDHP limits

The following chart shows the HSA and HDHP limits for 2024 compared to HSA and HDHP limits for 2023. It also includes the catch-up contribution limit that applies to HSA-eligible individuals who are age 55 or older, which is not adjusted for inflation and stays the same from year to year. You can view these limits in a downloadable PDF here.

Need help determining your coverage?

It’s important to review your HSA and HDHP limits annually. HANYS Benefits Services can help review your plans to see how the changes will affect you. For more information, contact us or call 800.388.1963 to speak with HANYS Benefit Services’ trusted experts about how you can prepare.

This Compliance Bulletin is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. ©2021 Zywave, Inc. All rights reserved.